Metcalfe’s Law and Its Significance in the Crypto Realm

Metcalfe’s Law, originally formulated to analyze communication systems like cryptocurrencies and blockchain networks, holds a critical role in the crypto landscape. Initially applied in telecommunications and then extended to various social and technological networks, Metcalfe’s Law was introduced by Robert Metcalfe, co-inventor of Ethernet. It gauges the importance and influence of networks by evaluating the connections between users.

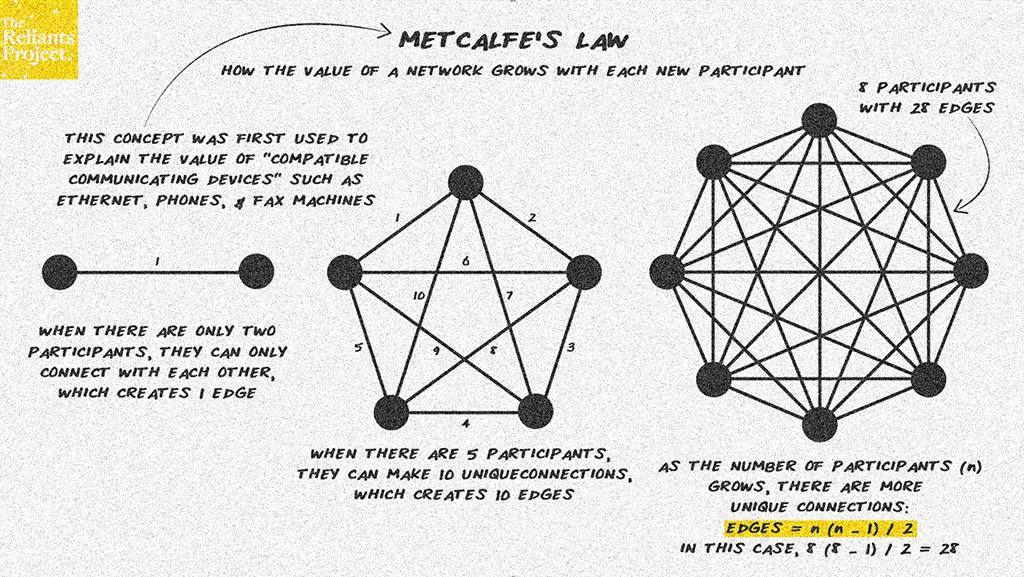

In the context of cryptocurrencies, Metcalfe’s Law asserts that a network’s value and utility increase exponentially as the number of users or participants grows. This phenomenon is pivotal in decentralized networks, as a higher user count results in greater potential for interactions, transactions, and network effects. Consequently, this fosters enhanced adoption and appreciation in cryptocurrency value. Contrary to linear growth, Metcalfe’s Law implies quadratic growth in the value of a cryptocurrency

network.

Furthermore, the value of a cryptocurrency network hinges on its adoption and practical applications. A widespread user base utilizing the cryptocurrency for diverse purposes bolsters the network’s potential for growth. Metcalfe’s Law also underscores the impact of network size on the value of the native token. As more users engage with the token in transactions, investments, and other activities, demand for the token rises, potentially driving up its price.

Various Network Effects in the Cryptocurrency Space

Numerous forms of network effects contribute to the expansion and value enhancement of cryptocurrency networks. These diverse network effects are exemplified below

Credit Scoring and Risk Management

AI can swiftly furnish DeFi lending platforms with credit scores and risk assessments, enabling informed lending decisions. By analyzing historical data, monitoring market dynamics, and offering real-time risk alerts, AI can fortify DeFi platforms against risks like price volatility and smart contract vulnerabilities, empowering robust risk management strategies.Fraud Detection and Security

AI algorithms can bolster DeFi platforms by identifying patterns, detecting anomalies, and heightening security measures to thwart potential fraudulent activities and cyberattacks. This integration enhances user protection and deters unauthorized access, enhancing the overall security quotient of decentralized ecosystems.Data Analysis and Decision-Making

AI’s capacity to scrutinize extensive datasets for insights, pattern recognition, and data-driven decision- making contributes to a smarter DeFi landscape. AI-powered algorithms can predict market trends and anomalies, facilitating personalized investment strategies aligned with user’s financial aspirations.

Interoperability and Collaborations Partnerships with external entities amplify a cryptocurrency’s utility, adoption, and visibility. Ripple’s XRP, for instance, has integrated into cross-border payment solutions through partnerships with financial institutions. Similarly, blockchain interoperability, exemplified by Polkadot, offers a seamless bridge between distinct blockchains, augmenting overall network usability.

The Relevance of Metcalfe's Law in the Cryptocurrency Space

Metcalfe’s Law holds profound relevance in the cryptocurrency domain, as it underlines pivotal aspects such as network adoption, decentralization, network effects, market valuation, scalability, security, and utility.

- Network Adoption and Value – Metcalfe’s Law accentuates the exponential rise in value that accompanies a cryptocurrency network’s expansion. As the user base grows, the network’s value skyrockets, fostering a positive feedback loop that attracts more users.

- Decentralization – Metcalfe’s Law aligns with the concept of decentralization, reinforcing the notion that a widely dispersed network is more robust and resilient against attacks. The increased number of nodes in a decentralized network mitigates risks associated with single points of control.

- Network Effects – Metcalfe’s Law underscores the pivotal role of network effects. As more users engage with a cryptocurrency network, its utility and appeal soar, driving adoption among newcomers and investors.

- Market Valuation – Investors and analysts can leverage Metcalfe’s Law to assess cryptocurrency projects more effectively. Networks with a larger user base typically possess higher intrinsic value, influencing investment decisions and market sentiment.

- Scalability and Competition – As networks expand, scalability becomes paramount. Blockchain capacity must accommodate escalating transaction volumes and user activity while maintaining optimal performance. Effective scaling solutions are essential to sustain network usability.

- Tokens and Utility – Metcalfe’s Law emphasizes the value of utility tokens, indicating that a token’s worth is contingent on the services, goods, or advantages it offers to users. As utility increases, token value follows suit.

Explaining Bitcoin's Price Formation Through Metcalfe's Law

Metcalfe’s Law partially explains the price formation of Bitcoin, particularly concerning the exponential relationship between its network size and value. As Bitcoin’s user base grew, a positive feedback loop led to increased value, attracting even more participants.

Bitcoin’s early days witnessed modest adoption and relatively low value. However, heightened awareness and usage spurred a network effect, propelling Bitcoin’s value. The milestone of over 400 million global Bitcoin users marked a significant acceptance milestone.

The 2017 bull run serves as a prime example of Metcalfe’s Law in action, with rising adoption and demand fueling Bitcoin’s price surge. Enhanced security, resulting from increased miner participation, bolstered investor confidence and trust, driving further adoption.

While Metcalfe’s Law provides valuable insights, other factors like market sentiment, macroeconomic trends, and technological advancements impact Bitcoin’s pricing. The law might oversimplify network value and disregard connection quality or external influences. Caution is advised when applying Metcalfe’s Law to cryptocurrencies, as it may not capture all dynamics, especially in cases of cutting- edge technology with limited acceptance or speculative bubbles.