Web3 and Financial Inclusion: Bridging the Gap for the Unbanked

In the contemporary digital landscape, the availability of financial services has emerged as an essential requirement for individuals and businesses.

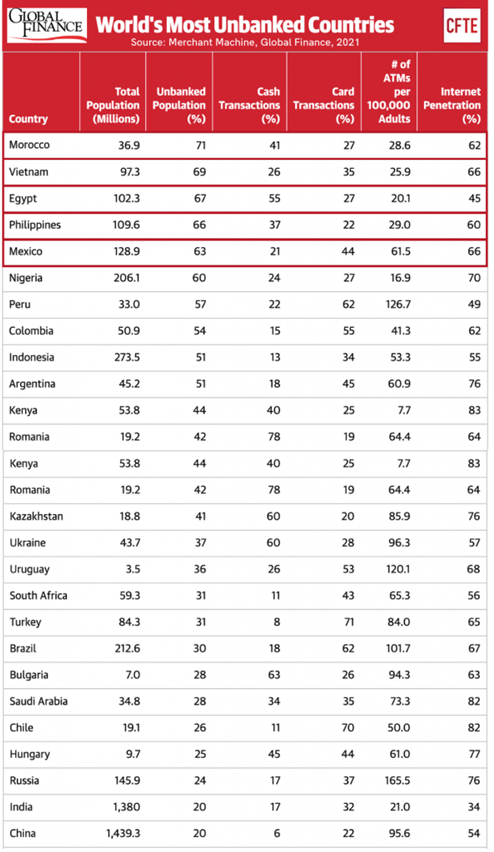

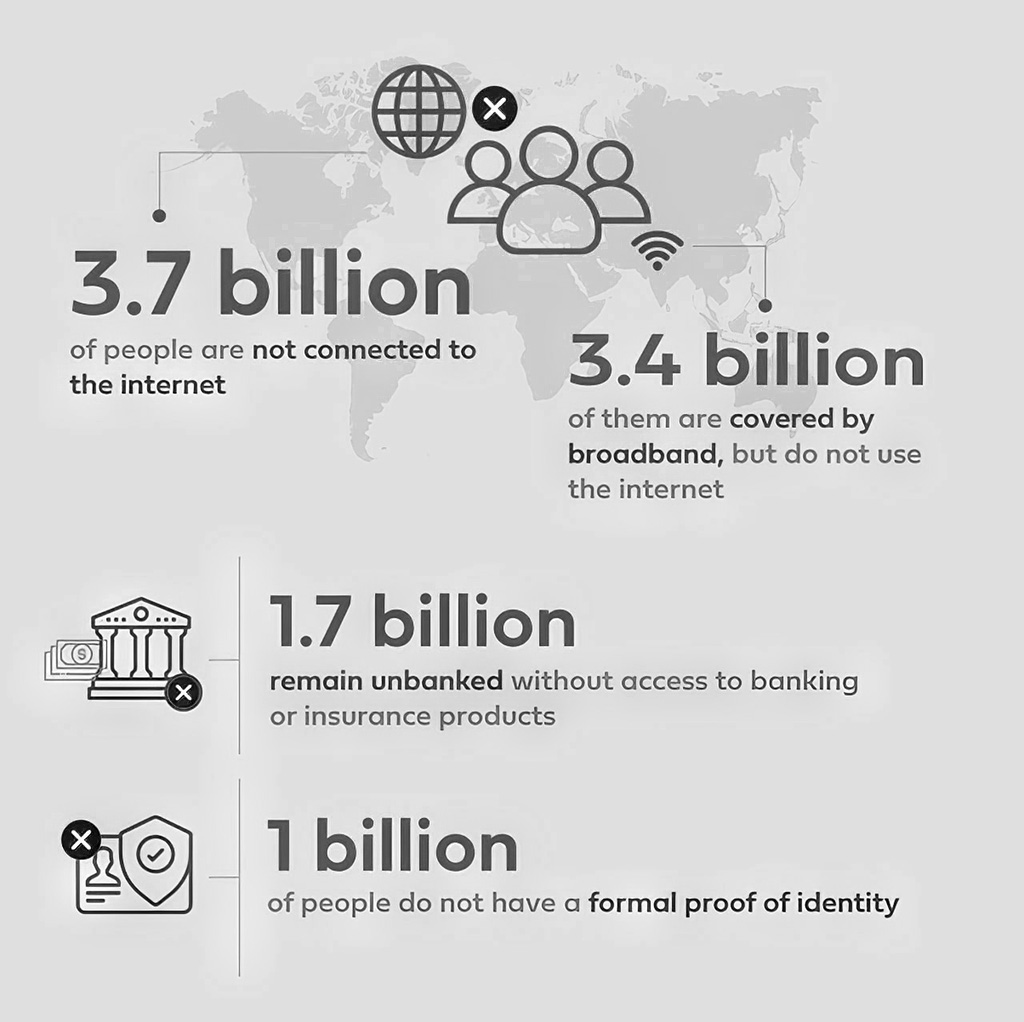

Nevertheless, a substantial segment of the global population continues to face challenges as they remain unbanked or underbanked, deprived of access to conventional banking systems.

This exclusion from the formal financial sector restricts their economic opportunities and hinders their ability to participate fully in the modern economy.

However, a glimmer of hope emerges with the advent of Web3 technologies and their transformative potential in the realm of financial inclusion. Let’s delve into the ways in which Web3 can bridge the existing divide for the unbanked population, propelling us towards a more inclusive and egalitarian financial landscape.

Understanding the Unbanked:

These individuals are effectively excluded from the fundamental benefits offered by traditional banking systems, such as access to savings accounts, loans, and insurance.

Consequently, they experience heightened vulnerability to financial instability and limited opportunities for economic advancement. The unbanked encounter a myriad of obstacles, ranging from geographical barriers and exorbitant transaction costs to the absence of necessary documentation and limited financial literacy.

Source – KaiOS Technologies

The Promise of Web3:

Web3, the next evolution of the internet, is a decentralized and user-centric model that aims to empower individuals and foster trust through the use of blockchain and cryptocurrency technologies. Unlike traditional financial systems, Web3 enables peer-to-peer transactions, eliminates intermediaries, and provides greater control and ownership of personal data.

These inherent features of Web3 have the potential to transform financial inclusion and empower the unbanked in several ways:

Access to Basic Financial Services:

Web3 technologies can provide the unbanked with access to basic financial services without relying on traditional banking infrastructure. By leveraging blockchain and cryptocurrencies, individuals can create digital wallets, make secure transactions, and store their assets in a decentralized manner. This opens up avenues for savings, remittances, and access to credit, allowing the unbanked to participate in the formal economy.

Lower Transaction Costs:

Traditional financial systems often impose high fees and transaction costs, making it uneconomical for the unbanked to engage in financial activities. Web3 eliminates the need for intermediaries, reducing transaction costs significantly. By leveraging blockchain technology, individuals can engage in low-cost peer-to-peer transactions, making financial services more affordable and accessible.

Financial Identity and Documentation:

A lack of proper identification and documentation is a major barrier to financial inclusion. Web3 solutions, such as decentralized identity platforms, offer self-sovereign identity management. Through cryptographic techniques, individuals can establish and control their digital identities, overcoming the reliance on physical documentation. This enables the unbanked to build a verifiable digital identity, unlocking access to financial services and other opportunities.

Microfinance and Crowdfunding:

Web3 opens up new possibilities for microfinance and crowdfunding, which can empower the unbanked to access capital and engage in entrepreneurial activities. Decentralized finance (DeFi) platforms enable individuals to access loans, contribute to investment pools, and participate in crowdfunding campaigns. These mechanisms provide alternative funding options for individuals and businesses that have been excluded from traditional financial systems.

Financial Education and Literacy:

Web3 technologies can also play a crucial role in promoting financial education and literacy among the unbanked. Through decentralized applications (DApps), individuals can access educational resources, interactive tutorials, and financial planning tools. These tools can empower the unbanked with the knowledge and skills needed to make informed financial decisions, fostering long-term financial stability.

Challenges & Considerations

- Internet connectivity plays a critical role in enabling access to Web3 technologies. Bridging the digital divide and ensuring widespread internet connectivity is crucial to reaching the unbanked population and providing them with equal opportunities in the Web3 ecosystem.

- To fully benefit from Web3 solutions, users must possess the necessary knowledge and skills to navigate the digital landscape, manage their digital identities, and securely interact with decentralized platforms. Educational initiatives and capacity-building programs are essential to promote digital literacy and empower individuals to participate actively in the Web3 economy.

- Regulatory frameworks must adapt to accommodate the unique features of Web3 technologies. As decentralized platforms and cryptocurrencies challenge traditional financial systems, regulatory clarity is necessary to ensure consumer protection, prevent illicit activities, and foster trust in the emerging Web3 ecosystem.

- Robust security measures, including encryption, multi-factor authentication, and auditing mechanisms, must be implemented to protect users’ assets and sensitive information. Building trust in the security and reliability of Web3 solutions is paramount to encouraging widespread adoption and usage.